Customers today are like gourmet diners in a fast-food world; their tastes are sophisticated, but they demand quick service. They’re seeking assurance, convenience, and customization. They want to interact through their preferred channels, whether it’s through an app, online chat, or a phone call, and expect these interactions to be swift and tailored to their needs. This shift requires insurers to overhaul traditional customer service models that were not originally designed for such agility or personalization.

For most of us as insurance customers, it’s hard not to get excited about a futuristic customer journey. Imagine you are a tech-savvy customer and damage your car in an accident. There’s no panic, just a swift chat with an AI assistant via your smart wearable that starts the claim process. The system, aware of your past interactions and preferences, tailors the communication style and process. The claim process, usually a maze, is now a straight line from problem to solution. This seamless journey, peppered with empathetic interactions and efficient automation, is the new face of insurance. Extrapolate this to more serious risks and imagine the impact it has on customer trust and loyalty.

How do we turn this future into reality?

AI and automation, of course, hold the key to most problems today, but the winners definitely take a specialized approach to create higher value – they listen to their customers. Here’s how you can understand what insurance customers want when it comes to customer services and deliver it.

- Understand the go-to channel for customers

Where do your customers go to find information solutions? Chat, self-service, or live agents? Turns out it depends on where they are in their insurance customer journey. For the simpler stuff, like learning about insurance or updating accounts, it’s a 50-50 split between talking to agents and clicking through digital channels. But when it’s time to buy policies or address issues – a solid 70% prefer the human touch. This isn’t a one-size-fits-all world anymore; today, it’s all about custom-fit solutions for every step of the journey – smooth transitions between channels, zero communication gap, and omnichannel experience. - Help them decode the product

There are complexities inherent and very specific to the insurance industry. Customers, often baffled, reach out to their insurers multiple times just to understand the different products. Even after buying, there’s a 40% chance they’re not fully grasping the value of their policy and want an exit. Add to this a chain of agents, brokers, and more, and we’ve got a recipe for customer confusion. How should insurers address this problem? Simplify, clarify, and educate. Translate insurance jargon into everyday language, making it accessible and understandable for everyone – like [24]7.ai’s chatbots do with their natural language AI capabilities. - Deliver empathetic CX

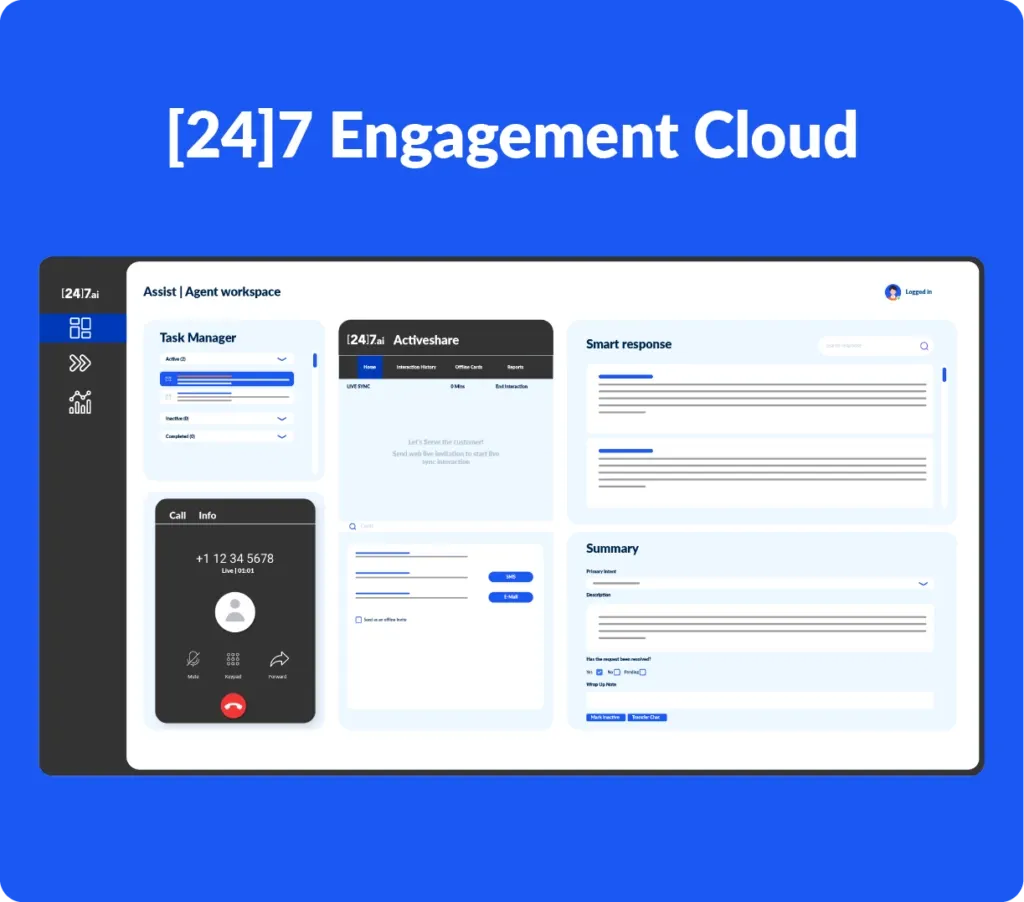

Insurance customers interact with their insurers only a handful of times a year, leaving insurance with only a handful of chances to make an impact. And more often than not, customers are on an emotional roller coaster during these times. It’s important that they receive empathetic CX. Arming employees and agents with the right tools and insights helps them ace these interactions. Done right, this not only uplifts customer experiences but also boosts employee morale and retention. It’s a win-win in a world where every interaction counts double. At [24]7.ai, we leverage 200+ AI-driven insurance intent models to streamline processes and tailor experiences at every customer touchpoint.

In a world facing increasingly complex risks, the insurance industry, a global safety net, calls for a major makeover, not just in operations but in its societal role. Are you ready to sharpen your tools and stay relevant in this rapidly evolving landscape?