A leading US credit union partnered with [24]7.ai to transform its member experience and reduce costs. The credit union faced challenges such as limited digital channels, lack of automation, long wait times, and insufficient metrics.

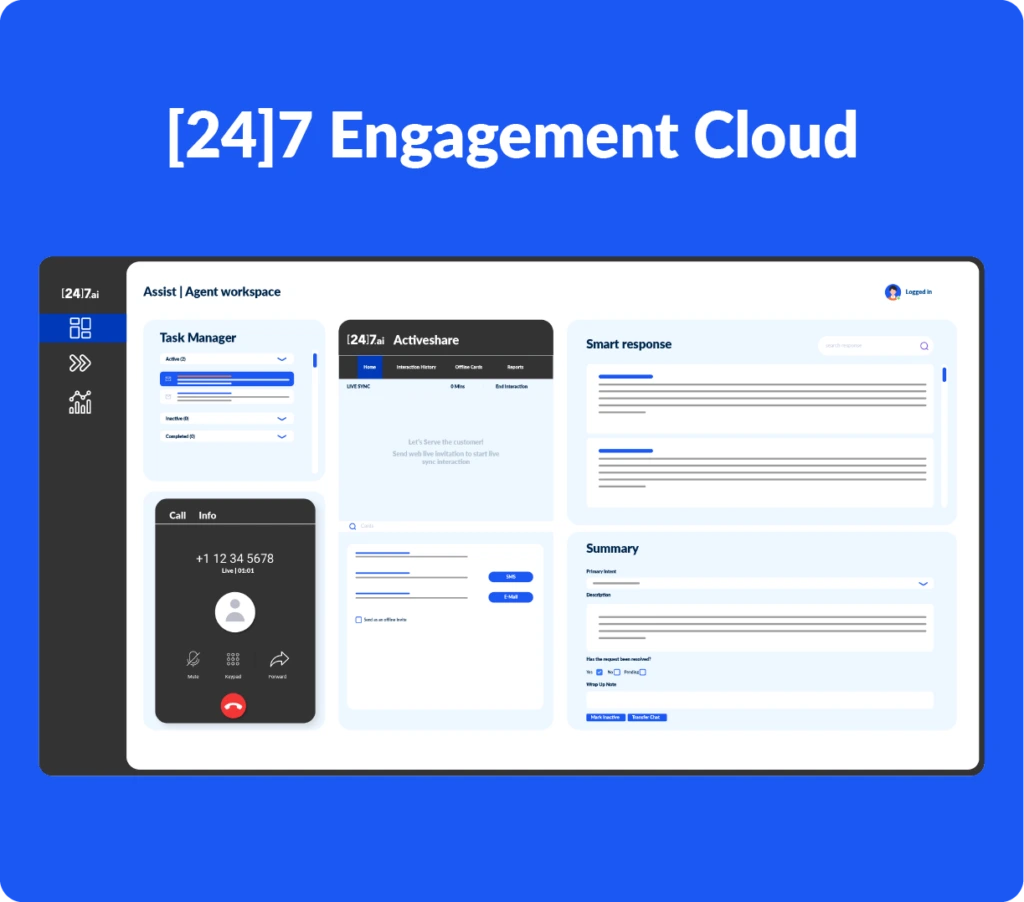

[24]7.ai’s solutions included AI-powered chatbots, proactive engagement, agent productivity tools, and comprehensive analytics. This resulted in several impressive outcomes:

- Reduction in call volume due to self-service options, saving costs

- Improved self-service resolution rate, freeing agents for high-value tasks

- Enhanced loan origination process with AI-powered bots, boosting revenue

- Improved member sentiment across satisfaction, loyalty, and ease-of-use

- Data-driven insights to optimize member experiences further

This partnership demonstrates the power of AI and digital channels in modernizing financial services. The credit union now provides a seamless, cost-effective, and personalized member experience, driving both member satisfaction and operational efficiency.

The results of this partnership have been remarkable – The credit union drove a massive 60% self-serve resolution success rate. That’s 60% less conversations that live agents need to handle for these specific topics.